Do you find yourself like a person who settles on the first thing to buy, they see in the or one who compares different shops to find the perfect deal? Everyone loves a good deal, right?Arbitrage funds are like wholesalers who look for the exact same product at different stores and then buy the cheaper one while another store is selling it at full price.They buy the product with a discount and immediately sell it to another for full price to another buyer. They are making a profit without taking much risk!

In mutual fund investments, Arbitrage funds are a type of investment fund that generates revenue through the buying and selling of securities in diverse markets. By doing so, they gain leverage from different market prices. Although they can be referred to as low-risk investments, they are still unpredictable.

How do Arbitrage funds work?

Arbitrage funds rely on profits based on the differences that occur in market prices from time to time. It’s like the case with most forms of investment, where you buy an asset and wait for it to sell when the price goes up for higher prices. Revenue is generated through different buying and selling prices; it’s a basic profit business!

What are the key features of Arbitrage funds!

Cash and future markets!

- Cash market or spot price

Since Arbitrage funds take advantage of the current price difference in the market, investors try to find assets with different prices. They try to identify assets that are trading at lower values in the cash market and selling in the future at slightly higher prices. In trading, the cash market is a market where trades are settled simultaneously, like buying and selling at the spot.

- Future market

The futures market differs slightly from the cash market. It’s a derivative market, meaning its value depends on the underlying asset.Derivatives rely on the expected performance of a particular stock in the market. Fund managers try to buy assets at lower rates in the cash markets and sell the same at a certain higher rate than in the derivative market. This buying and selling of securities is settled at the futures market. For example, a X fund house buys a security at the 500-rate spot price and sells it at the higher price of 550 in the derivatives market. Making a profit is different from 50!

A Low-risk position!

The whole process of buying and selling assets in the cash market and futures market is a low-risk zone that promises profit. Investors who are interested in utilizing their chances in the volatile market look forward to Arbitrage funds. The immediate buying and selling of assets impose lower risk in terms of lump-sum investments. In Arbitrage funds, a portion of the funds is invested in debt securities, making them stable options even in the unpredictable waters of the investment market. This is beneficial for investors with low-risk tolerance and promising revenue.

Market volatility

The volatile market refers to the unprecedented changes or fluctuations in the market value of an asset. It measures the risk associated with the market dynamics,which changes from time to time. Arbitrage funds are considered a good choice as they can thrive even in the shakiest market chaos while ensuring good returns.

Tax and equity

Arbitrage funds include investments in both debt and equity funds; hence, they are called hybrid funds. An equity fund is a type of investment that offers long-term returns to the investors. It allows investors to diversify their investment approach, acting on the safe side if one or more stocks have poor performance in the market. Arbitrage funds are balanced; 65% of their assets are allocated in equity.Hence

They are taxed similarly to equity funds. The plus point is that if shares are held for at least a year, the tax rates are lower than they usually are. Arbitrage funds make use of adding capital gains and receiving good returns from multiple sources.

Short-term capital gains account for 20% of tax, whereas long-term gains account for 12.5 % if they surpass 1.25 lakh.

-

Some of the benefits of Arbitrage funds are as follows:

Low-risk investment

Investment is a game of risk! Certain risks persist even if they are mitigated properly. Arbitrage funds like to capitalize on every short-term difference that is subject to the low impact of market fluctuations. It could potentially lower the risk for investors.

Taxation benefit

Being treated as a hybrid fund, Arbitrage funds receive similar treatment to equity; hence, they gain an advantage from taxation. The balanced investment in both debt and equity funds makes it a stable option.

Promising good returns

Even if the situation is unpredictable and shaky in the market, Arbitrage funds offer a good and steady return. Arbitrage funds make good use of volatile markets where fund houses can utilize these opportunities in market conditions.

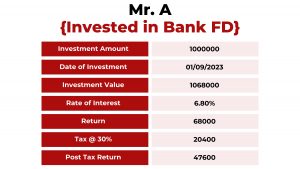

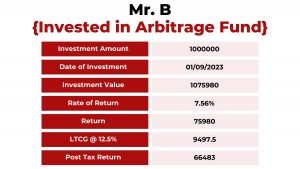

Let’s compare Traditional Bank FDs and Arbitrage Fund with an example:

Imagine Mr A and B have taken a hike, where A has chosen a familiar path(Traditional Bank FD).While B has taken a rather different adventurous route(Arbitrage funds).

Mr. A, hasn’t utilized the LTCG exemption. He’s comfortable with his investment strategy and doesn’t want to take any risks(Traditional Bank FD).

Mr. B, has utilized the LTCG exemption. He’s willing to take a calculated risk to earn a higher return(Traditional Bank FD) potentially.

Now, considering both Mr A & B falls under the 30% tax bracket.

And considering Mr. B has utilized the LTCG exemption limit of 125000

Hence by choosing Arbitrage Fund, Mr. B has earned an extra return of 18883

Drawbacks of Arbitrage funds

They need constant attention to identify the differential price of an asset in the market.The transactions and execution cost of Arbitrage funds generate higher expense ratios.

Subject to Interest rate and market fluctuations

Arbitrage invests both in debt instruments and equity. Equity is subject to volatile market conditions while debt is affected by interest rate fluctuations. So, the portion of debt instruments always produces the possibility of fluctuations in interest rates.

Payoffs are unpredictable.

In terms of reliability, Arbitrage funds may have an unpredictable payoff due to a lack of fund opportunities in stable market conditions. A volatile condition widens the difference between buying and selling prices; however, too sudden price change makes it difficult to carry out trades at desirable rates.Further wider difference at market price can negate the profiting strategy behind arbitrage.

Volatility can leave no opportunity If they are not profitable, Arbitrage funds give inconsistent returns.

Who is it for? Factors to consider!

Overall, investors who are interested in low-risk investments and want to diversify their portfolios may look for Arbitrage funds. They offer steady and low-risk returns and capitalize on the market differential price. However, their predictability and risk are subject to market dynamics and the presence of Arbitrage opportunities. Interested investors should consider all their options and factors, like express ratios, market dynamics, and investment risk, before choosing Arbitrage mutual funds.

Please share your thoughts on this post by leaving a reply in the comments section. To learn more about mutual funds, contact us via Phone, WhatsApp, Email, or visit our Website. Alternatively, you can download the Prodigy Pro app to start investing today!

Disclaimer – This article is for educational purposes only and by no means intends to substitute expert guidance. Mutual fund investments are subject to market risks. Please read the offer document carefully before investing.

Name: Understanding Treasury Bills (T-Bills): Safe, Short-Term Investments - BFC Capital- Blogs : All Financial Solutions for Growing Your Wealth

says:[…] Also, check out our recent post on “All you need to know about Arbitrage funds!“ […]