Fixed deposits, or FDs, are still one of the most sought- investment options in India. This is because they are less prone to market fluctuations than other options. They also come with guaranteed returns. However, if you’re concerned about the falling interest rates of FDs, you may want to explore other investment options. And if that’s your dilemma, you can take a breath, as there are alternatives available for you- Corporate FDs. Continue reading if you’re wondering how Corporate FDs are different from Bank FDs because we have broken it down for you.

What are Corporate FDs?

Let’s begin by understanding what Corporate FDs are.

Under Indian banking laws, private organisations and non-banking financial companies (NBFCs) can collect deposits for a fixed tenure. These deposits, like Bank FDs, are collected at predetermined interest rates. These types of deposits are known as Corporate FDs. Similar to Bank FDs, Corporate FDs offer varying investment tenures and guaranteed returns. Additionally, they offer higher interest rates as compared to Bank FDs.

What are Bank FDs?

As the name suggests, fixed deposits offered by banks are known as Bank FDs. Bank FDs are a traditional approach to investing and have been a favourite among people for years. Despite their falling interest rates, they still haven’t lost their stronghold in the investment market as they provide additional protection through the RBI’s directive of mandatory deposit insurance for banks.

Difference Between Corporate FDs and Bank FDs

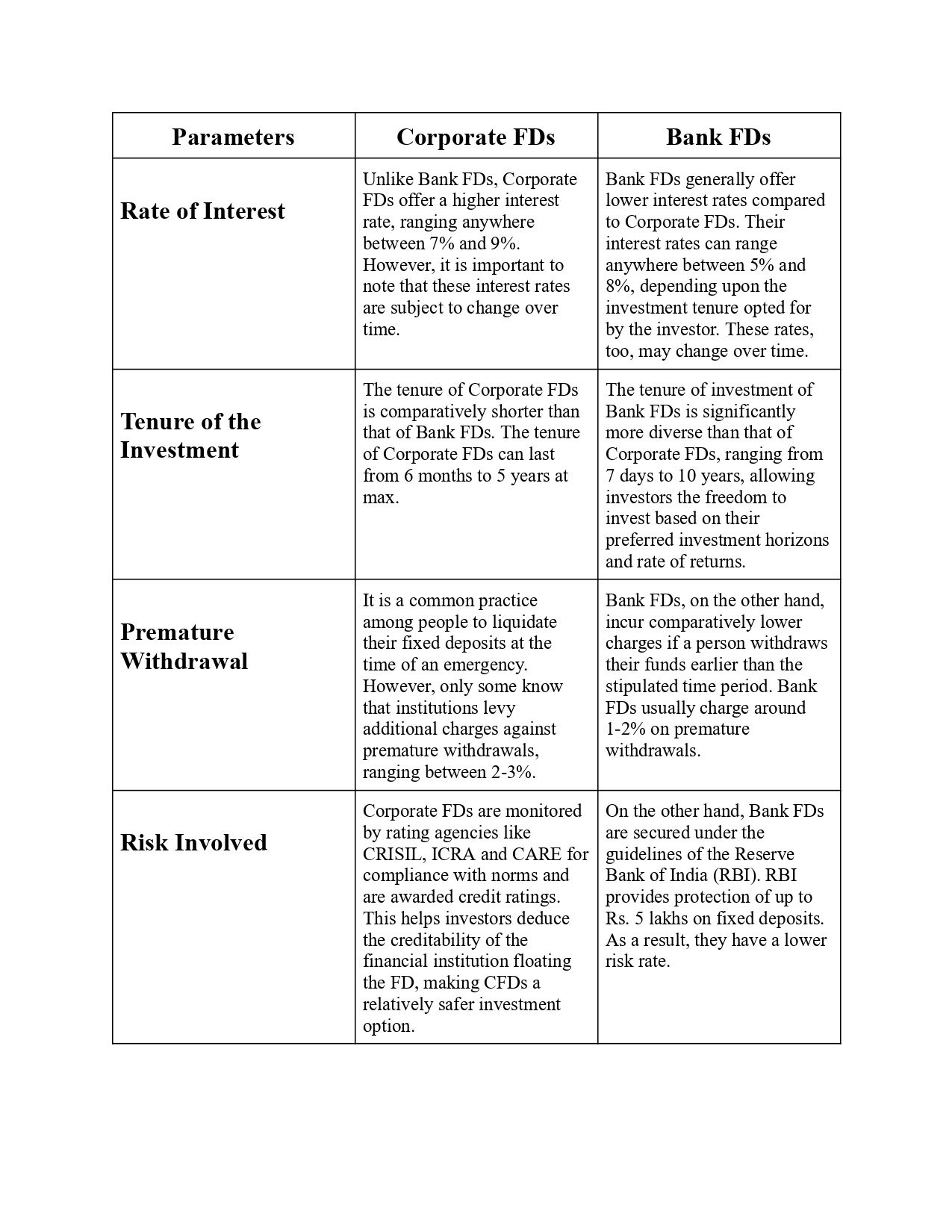

While you can opt for either of the FDs based on your requirements, knowing the difference between the two is crucial to make an informed decision. Mentioned below are some important parameters based on which you can differentiate between Corporate FDs and Bank FDs.

Conclusion

Conclusion

By now, we’re sure you understand the fundamental differences between Corporate FDs and Bank FDs. It is crucial to consider your investment objectives before choosing either of them. You must carefully evaluate the rate of interest, the tenure of the FDs, and the investment risk associated with each fixed deposit. Both options offer unique benefits, ensuring a safe and stress-free investment experience.

Please let us know your thoughts on this post by leaving a reply in the comments section. Also, check out our recent post on “How to Achieve More with SIPs.”