Mutual Funds vs Fixed Deposits

Think that you are setting off on a journey. Your destination is financial security and achieving your long-term goals. The path you choose will determine how you get there. Think of FDs as a well-paved highway. It is a smooth ride with a clear destination, which means guaranteed returns and predictable arrival time, a fixed period for which it is invested. At the same time, mutual funds can be described as a more scenic route. The journey is often more enjoyable because this can be faster, that is, the coverage of more returns, but there can also be declines and detours because of market conditions.

The goal of this blog post is to give you an idea of the two main types of investment tools and help you select the best one to help you achieve your investment objectives.

What is a Fixed Deposits (FD)?

Think of when you used to put your money in a piggy bank. The money did not magically grow. Instead, it would equal the amount you had put in; that’s where a fixed Deposit comes in. A fixed deposit (FD) is like a piggy bank, which is exclusive to you and is maintained by the bank. Suppose you have a little more than average money saved and are sure you will not need any cash for a certain period. In an FD, you lock in this amount for a specified time, for instance, one year or five years. It assures you a specific interest rate on your deposits as you tie your cash with the bank for a particular period. It is as if a noble form of compensation for your patience.

What are the benefits of Fixed Deposits (FD)?

Fixed deposits (FDs) offer several advantages, making them a popular pick for many investors. Here’s a breakdown of their key benefits :

Safe and Secure: Similar to the piggy bank where your money is secure, FDs are forms of low risk investments. It ensures that you will get back your initial investment together with a certain percentage of interest; it is ideal, especially for conservative investors who do not wish to risk their investment but wish to get a slightly higher return than what they are currently receiving.

Predictable Growth: Unlike a regular piggy bank, where you might just guess how much you’ve saved, FDs offer a fixed interest rate. It’s like knowing exactly how many extra coins you’ll get to keep your money in the particular FD piggy bank. Predictability makes you better prepare your finances and do it in the best way possible.

Earn More than Savings A/C: A traditional piggy bank may not open to you with extra coins after some time, but an FD comes with interest payment, often higher than what you can expect from most savings accounts. It is like your unique FD piggy bank paying you extra for putting your money there.

Tax advantages: Under Section 80C of the Income Tax Act, tax-saving FDs are eligible for deductions up to a maximum of Rs. 1.5 lakh. Senior citizens also receive a tax break on the interest they earn on FDs.

Who should invest in Fixed Deposits (FD)?

Fixed deposits (FDs) are a good fit for several investor profiles; here’s who might benefit most from this “special piggy bank” option:

Risk-averse investors: Prioritise safety and predictable growth. FDs offer guaranteed returns, making them a secure option.

Short-term goals: Saving for a vacation or appliance in a few years? FDs with matching terms ensure you have the money you need.

Senior Citizens: Are you seeking a reliable income stream for retirement? Non-Cumulative FDs provide regular interest payments, and some banks offer higher rates for seniors.

Tax-conscious investors: Want to minimise taxes? Tax-saving fixed deposits offer tax deductions under Section 80C.

What is a Mutual Funds?

Mutual funds refer to pooled investments whereby people with similar investment objectives come together with their funds to invest in different asset classes, such as equity, debt, real estate, gold etc. Suppose you accumulate cash with friends, go to the market, and then purchase different fruits such as apples, bananas, oranges. The share is then split according to the proportion of contribution made by each person. A professional fund manager is like a friend who knows the best deals, selects these investment options, and invests in the market to achieve growth. Investing in mutual funds can be bumpy like a rollercoaster, but it allows your investment to grow faster than keeping your money tucked away.

What are the benefits of investing in mutual funds?

Mutual funds offer several advantages over saving money on your own, making them a growth-oriented upgrade to your piggy bank. Here’s a breakdown of their key benefits:

- Diversification: How about eating different varieties of fruits and not just apples? This ensures that you get a well-balanced nutritious diet and all the vitamins your body requires. Similarly, through diversification, you can get your money spread across asset classes and get sweet returns like eating a mango. This way, you can also take on bets with risky assets because all your money is not vested in a particular investment.

- Professional Management: Wouldn’t having a friend who is good at bargaining pick the best deals at the market be great? Mutual funds provide similar expertise. Professional fund managers, with their knowledge and experience, research and choose investments aiming for growth. You benefit from their skills without needing to become an investment guru yourself.

- Potential for Higher Returns: While an ordinary piggy bank keeps your money safe until you’re ready to take it out, mutual funds ensure it earns more. Diversifying your portfolio across different asset classes can add returns to your idol savings. However, this does not mean that people should forget that even investments are subject to market changes.

- Affordability: Mutual funds are like buying a piece of a delicious cake. You don’t need to buy the entire cake to enjoy its taste. With mutual funds, you can start with a small slice (investment) and gradually increase your share over time. This makes it a sweet deal for investors with different budgets.

- Liquidity: While some mutual funds have lock-in periods, many offer easy redemption options. This means you can access your invested amount, partially or entirely, within a reasonable timeframe, unlike a fixed deposit where your money is locked for a specific period.

Who should invest in Mutual Funds?

Mutual funds are a good fit for investors seeking:

Growth: Willing to accept some market fluctuations for the chance of higher returns compared to savings accounts.

Diversification: Prefer a basket approach, spreading risk across investments like stocks and bonds.

Professional Management: Value expert guidance in choosing and managing investments.

Affordability: Want to access a diversified portfolio without needing a large sum of money upfront.

Flexibility: They need some liquidity and the ability to redeem their investment within a reasonable timeframe (depending on the fund).

Also check – Best Mutual Funds to Invest in 2025

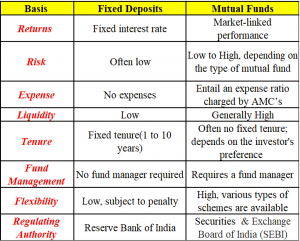

Mutual Funds vs Fixed Deposits:

Winding up thought

While fixed deposits (FDs) have been a trusted companion for Indian investors, mutual funds offer a compelling alternative. They have the potential for higher returns and boast tax advantages. Unlike FDs, where interest is taxed as it accumulates, mutual funds allow your returns to grow tax-deferred, with taxes only applied upon redemption at a profit. Additionally, mutual funds can effectively combat inflation, a challenge FDs often need help with.

Some of these investors find the central challenge related to mutual funds to be their fluctuation. However, you should note that market volatility is something one must accept when investing in any market-related product. At this particular point the market prizes an investor, who can work with the fact to take the short-term volatility-impacts usually with handsome long-term returns. Fortunately for the investors, the choice of mutual funds is vast and have multiple category to opt for their fit of risk-return. If you are a newbie, you can begin investing with little amount of capital and move up to investing with good amount of capital as you move up the ladder of becoming a professional investor.

All in all, it can be concluded that the best choice out of the two options depends on your individual needs and risk tolerance. Subsequently, you should look at what your financial objectives are, how long of a time frame you want to invest for, and whether you can handle some short-term volatility. This blog post has equipped you to make an informed decision. So, buckle up and choose the investment path that takes you on the smoothest ride towards achieving your financial dreams!

Please share your thoughts on this post by leaving a reply in the comments section.

Contact us via Phone, WhatsApp, or Email to learn more about mutual funds, or visit our Website. Additionally, you can download the Prodigy Pro app to start investing today!