Imagine that you’re planning a cross-country road trip. You have two options: take a guided tour bus or rent a car. The tour bus offers a fixed itinerary, comfortable seats, and an experienced guide. It’s safe and hassle-free. Meanwhile, the rental car is flexible and allows you to explore off-beaten destinations. But it requires more risk-taking and meticulous planning.

In the investing world, mutual funds and hedge funds are similar to a guided bus tour and a rented car. Both are financial vehicles for investments, but they offer largely diverse experiences.

Let’s break down the concept of mutual funds and hedge funds, and elaborate further on their significance and differences.

Mutual Funds: The Guided Tour To Kickstart Your Investment Journey

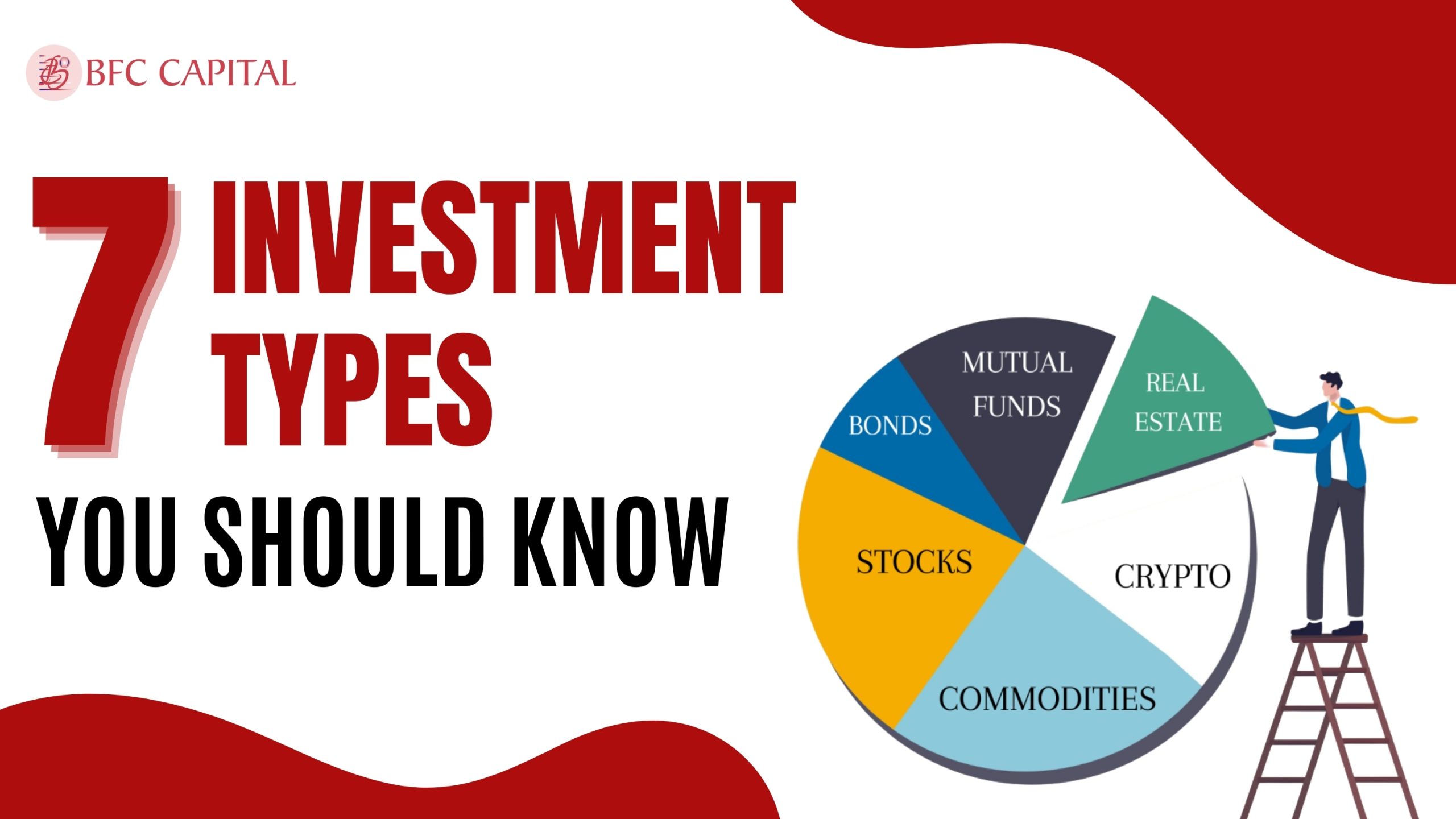

Mutual funds are financial instruments where collected money is pooled, by investors, into different securities such as bonds, stocks, and other market instruments. They entail long-term potential returns and diversification. The mutual fund market has a wide range of risk-tolerant options of actively managed funds.

Any investor with an eligible investment account might invest in mutual funds. Each of these investors then buys a share in these funds where the share represents their part in the ownership of the fund and the overall income it will generate. Further, the generated income or gains collected from a mutual fund investment may incur additional deductions.

Note: The combination of all the mutual fund holdings is known as an investment portfolio. The portfolio helps outline the goals and methodologies for more informed investment strategies.

Now think of a mutual fund as a guided tour bus. The fund manager is the tour guide who selects the best destinations and ensures a smooth journey. Here, the destinations are equal to the investments. The passengers, onboard the bus, ensure a fruitful journey, just like the investors, contribute money to the fund.

In India, mutual funds offer an accessible and transparent means to enter the stock market. They are governed by the Securities and Exchange Board of India (SEBI).

Why Do Investors Choose to Invest in Mutual Funds?

Mutual funds are one of the top choices for investors. Investing in mutual funds entails professional management i.e., the fund managers choose the securities for you, conduct extensive research, and monitor their performance regularly.

Additionally, mutual funds enable diversification of your investments. Mutual funds generally allow investments across a diverse range of industries and businesses. This helps lower the potential risks if one of the businesses declines.

Besides, most mutual fund investments require a relatively lesser initial payment and consequent purchases. This ensures affordability for people across all income ranges.

Lastly, mutual funds’ liquidity is another factor that makes it a popular choice among investors. They are allowed to redeem their shares at any given time at the current Net Asset Value (NAV) along with the redemption fees.

Mutual fund managers are highly experienced professionals. Not only do they research industries, and study market trends, but also make strategic decisions. By investing in mutual funds, you indirectly hire an expert team to manage your hard-earned money.

The Adventurous Investment Journey: Venture of the Unknown Path of Hedge Funds

Hedge Funds are private investment partnerships, offshore investment corporations, money fools, or funds that trade or invest across diverse markets and financial instruments such as non-securities, securities, and derivatives. These funds are unregistered and not subject to the regulatory requirements of mutual funds.

However, sometimes even venture capital funds, commodity pools private equity funds, and other unregistered investment pools are referred to as hedge funds. They are similar in terms of accepting and investing investors’ money on a collective basis.

If we previously illustrated mutual funds as guided tour buses, assume hedge funds as a group of adventurous backpackers. As a backpacker, you venture off unknown paths, explore remote villages, and hike mountains. You take risks and embrace uncertainty to pursue maximum rewards in terms of beautiful scenery or satisfaction in completing your daily steps.

But, this freedom has its challenges. Backpackers are expected to be prepared for obstacles, have an in-depth understanding of the terrain, and be willing to adapt to the changing circumstances. There are similar steps that investing in a hedge fund requires.

Hedge funds also comprise an investor base that includes wealthy institutions, individuals, and a high minimum limit.

Why Do Investors Choose to Invest in Hedge Funds?

Investing in hedge funds contributes significantly to increasing market efficiency and enhancing liquidity.

Now, imagine a bustling marketplace where many vendors sell different goods. But, some of the vendors are concerned about potential losses. To avoid this, they initiate ways to protect themselves. For example, the hedge fund might agree to purchase a farmer’s potatoes at a predetermined rate irrespective of any current or future market fluctuations.

In simpler terms, hedge funds take on the risk that the farmers are trying to avoid. Hence, the hedge funds may potentially serve as existing counterparts to entities that want to limit risks.

In another scenario, imagine that the prices in this marketplace are determined through supply and demand. If the farmer sells a potato that is high in demand but has low supply, the price will be high. Similarly, if the potatoes are in low demand but high supply, the price will be low.

Hedge fund traders, through the above strategy, purchase or sell funds at a price that they believe is overvalued or undervalued. When they purchase goods they believe are undervalued, they essentially increase their demand thus potentially driving up their price. Conversely, when they sell an overvalued product, they decrease its demand, driving down its price.

Make an Informed Decision By Understanding the Significant Differences

Mutual funds are often a passive investing instrument whereas hedge funds are more active. While the strategies used in the former are less risky and more predictable, the latter is more susceptible to risks. The focus here is to generate returns regardless of the market movements.

Both of these are ideal instruments for investments that can have good returns. But, they differ on certain levels that can significantly impact your investment. So, how do you choose between mutual funds or hedge funds?

- Investment Strategies

Mutual funds follow the traditional investment strategies where the fund/portfolio manager helps you diversify your portfolio by investing in stocks, bonds, and other market instruments for steady returns and low risk.

Whereas, investors who invest in hedge funds have high-risk tolerance and a huge investment account to maximize returns to their full potential even if it involves high risk. It requires diverse advanced strategies such as derivatives, short selling, arbitrage, and leverages.

- Who Are the Investors?

Mutual Funds cater to several types of investors. There are no special qualifications required to invest in mutual funds. From seasoned investors to beginners, everyone can afford to invest in mutual funds as the mininum amount required is very low.

On the other hand, hedge funds are not flexible and only cater to accredited and institutional investors such as endowment funds or wealthy individuals. The initial investment amount is also quite high with high risk potential.

- Type of Investment

Diversification is an common strategy carried out in mutual fund investment. The investments, however, are made in a limited pool of securities and are based on the type of mutual fund.

Conversely, hedge funds invest in a diverse range of assets. The securities comprise bonds, equities, currencies, commodities, real estate and other alternate instruments. Here, the priority is to invest in any securities that promise higher returns even if the risks are high.

- Additional Fees

Mutual funds investment entail an expense ratio that includes opretaional costs, management fees, entry and exit loads. These fees represent a certain percentage of the mutual fund’s average assets under management (AUM).

The additional fees charged by hedge funds are higher than mutual funds. The fee structure comprises management fees and performance fees i.e., the portion of the investment gains. This fee is given to the fund manager who oversees your fund’s investments and operations.

- Lock-in/Holding Period

Mutual funds do have a minimum holding period, until the completion of which, investors are not allowed to redeem their investments. This period may range between several months to years that ultimately also defines the taxability of the returns.

Hedge funds also have a pre-set holding period that puts the restriction on redeeming an investment. The overall term depends on the fund’s structure.

- Compliance and Regulation

The Securities and Exchange Board of India (SEBI) regulates mutual funds in India. There are guidelines placed to enable reporting, transparency and protection. The compliance and regulations required are relatively higher than for hedge funds resulting in more transparency.

However, SEBI doesn’t regulate hedge funds in India. This lessens the regulatory and compliance requirements of these funds compared to mutual funds. Besides, hedge funds still have to follow the general taxation and investment laws introduced by the government.

Concluding Points!

Both – mutual funds and hedge funds – are designed to cater to different investors. Investing in mutual funds are simpler, whereas hedge fund strategies are aggressive. Moreover, mutual funds are regulated, publicly offered, and allow daily trading. Meanwhile, hedge funds are private and employ potentially high-risk strategies to generate higher returns.

To choose between the two, focus on your financial goals, investment horizon and risk tolerance capabilities. If you’re a conservative investor, mutual funds might offer you more stability and security. Choose this option to grow your money over time. But if you want to rapidly increase your gains, irrespective of the high risk and a capacity to bear any losses, hedge fund could be the answer for you.

There are two roads – a steady and guided bus journey of mutual funds and the unpredictable and adventurous backpacking journey of hedge funds. Which will be the road you take to invest wisely and achieve you financial goals?

Please share your thoughts on this post by leaving a reply in the comments section. Also, check out our recent post on: “Bond Funds vs Bond ETFs: What’s the Difference?“

To learn more about mutual funds, contact us via Phone, WhatsApp, Email, or visit our Website. Additionally, you can download the Prodigy Pro app to start investing today!

Disclaimer – This article is for educational purposes only and by no means intends to substitute expert guidance. Mutual fund investments are subject to market risks. Please read the scheme-related document carefully before investing.