Tax is a compulsory fee implemented on individuals or companies by the Central and State Governments to help establish the economy of a country by meeting different public expenses.

These taxes are largely categorized into two types – Direct tax and Indirect tax.

In this blog we will tell you everything you need to know about Direct & Indirect tax.

Why are Taxes Imposed?

Taxes are necessary because they constitute the government’s basic source of revenue. The revenue raised is used to pay government expenses such as education, health care, and infrastructure development, such as roads and dams.

What is Direct Tax?

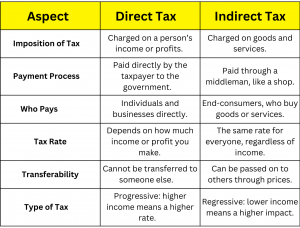

Direct Tax is paid by a person directly to the government. A taxpayer is not allowed to transfer this liability to another entity or person. The Central Board of Direct Taxes (CBDT), which is controlled by the Department of Revenue, handles direct taxes in India. CBDT also plays a determining role in the planning stages concerning the implementation of direct taxes.

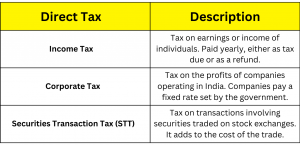

What are the Direct Taxes Imposed in India?

Advantages of Direct Taxes

Direct taxes help a country in several ways:

- Reduces Inflation: When prices go up, the government may increase taxes. This lowers demand for goods and services, which can help reduce inflation.

- Promotes Fairness: Taxes are based on how much people earn. The government sets tax rates and exemptions to help balance income differences among people.

Indirect Tax

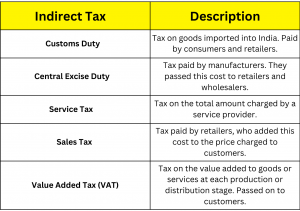

The government imposes indirect tax on goods and services. So, it can be transferred from one tax-payer to another. For example, the wholesaler can transfer it on to retailers, who then transfer it to consumers. Therefore, consumers bear the liability of indirect taxes. The Central Board of Indirect Taxes and Customs (CBIC) regulates and administers indirect taxes.

Previously, an indirect tax signifies paying more than the real price of a product purchased or a service obtained. And there was a manifold indirect taxes levied on taxpayers.

What are the Indirect Taxes Imposed in India?

GST as an Indirect Tax

Since GST started, it has brought many positive changes to India’s tax system. Many old taxes are no longer needed, and GST helps make the idea of “One Nation, One Tax, One Market” a reality.

One big benefit of GST is that it removes the problem of “tax on tax.” This is when consumers end up paying extra tax on the tax already included in the price of goods or services, which makes prices higher.

With GST, customers no longer have to pay this extra tax, so prices are more straightforward and fair.

Advantages of Goods and Services Tax (GST)

Here are some benefits of GST:

Input Tax Credit: When you pay tax on a final product, you can subtract the tax you already paid on your purchases. This lowers the total tax you need to pay.

Composition Scheme: Small businesses with a turnover below ₹1.5 crore (or ₹75 lakh in North-Eastern states and Himachal Pradesh) can use this scheme. They don’t need to handle complex GST rules and just pay a fixed tax rate based on their sales. This makes things easier for small businesses.

Zero-Rated Exports: No GST is charged on goods or services exported from India. Exports are considered tax-free.

Easy Compliance: New digital tools, like online forms and electronic invoicing, make managing and paying taxes simpler and more efficient.

Difference Between Direct and Indirect Tax

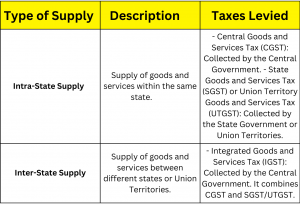

Types of Supplies and the Taxes on Them

Final Words

Understanding direct and indirect taxes, and their benefits like GST, helps manage taxes better. Direct taxes are paid directly, while indirect taxes are passed on through prices.

Want to learn more about taxes and how they affect you? Explore our guides or talk to our tax expert today!

To learn more about mutual funds, contact us via Phone, WhatsApp, or Email, or visit our website. Additionally, you can download the Prodigy Pro app to start investing today!

Disclaimer – This article is for educational purposes only and does not intend to substitute expert guidance. Mutual fund investments are subject to market risks. Please read all the scheme-related documents carefully before investing!