People love to embrace ‘diversity,’ mainly because it signifies varieties, inclusion, and representation of different backgrounds. They relish watching culture and taking part in it. However, when it comes to mutual fund investments, they do not pay close attention to diversification. It is crucial to comprehend that just investing in mutual funds will not yield profitable returns. It demands your time, research, and diversification. Therefore, if you are wondering why portfolio diversification is essential and how to build a diversified portfolio, this article is for you. Read further to learn the basics of portfolio diversification.

A Look into Portfolio Diversification

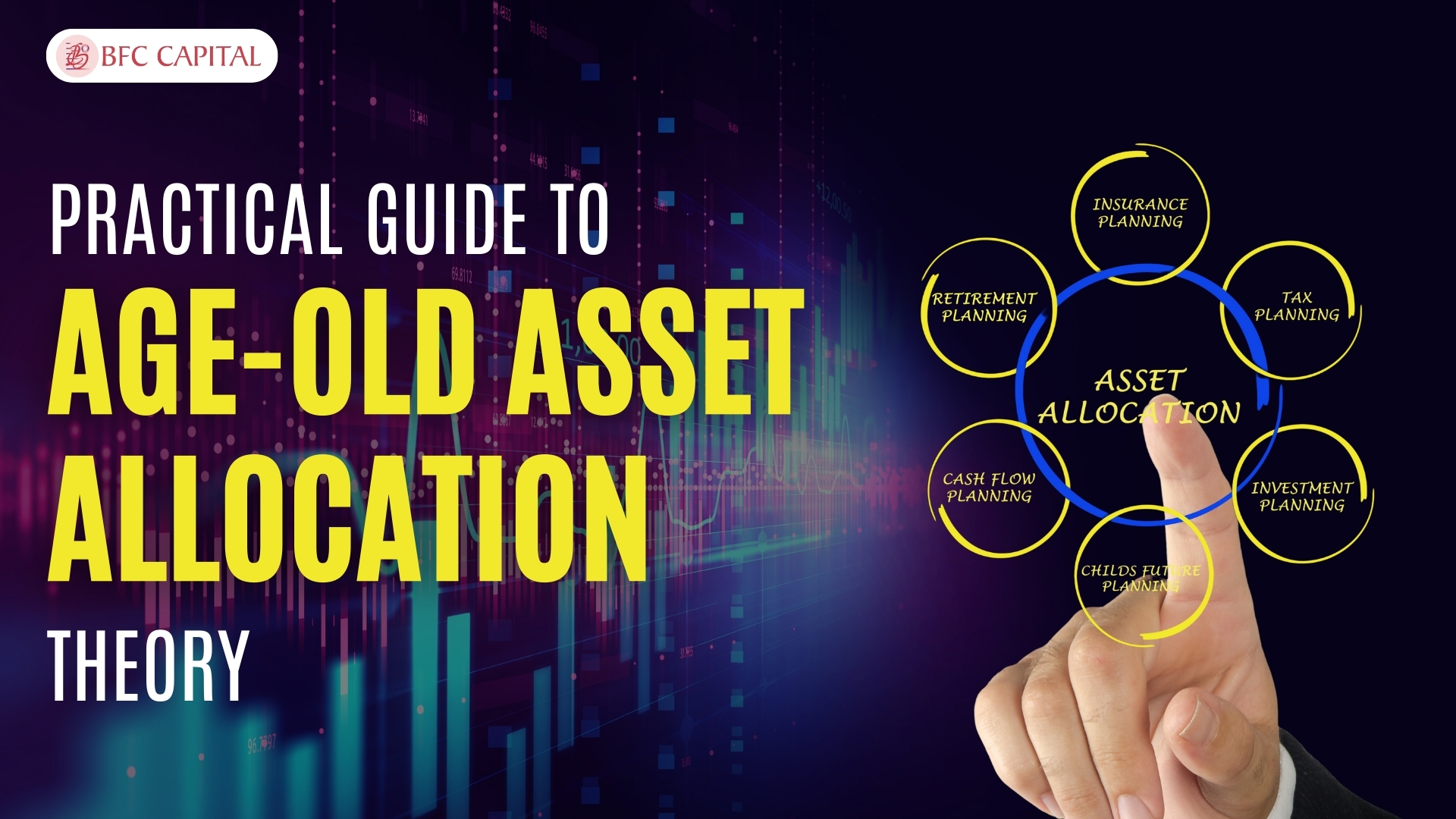

Mutual funds pool money from multiple investors and use it to invest in numerous asset classes, making it easier for investors to achieve diversification without the need for substantial capital or expertise in managing a diversified portfolio. Portfolio diversification aims to reduce the risk associated with any single investment by making necessary adjustments and ensuring that the portfolio is in alignment with the financial objectives of the investor. Consequently, a diversified portfolio can potentially offer more stable returns over time, as gains in some assets can offset losses in others.

How Correlation Impacts Portfolio Diversification

When diversifying your portfolio, it is crucial to check the funds in which you have invested. In a portfolio, low or negative correlations between assets can enhance diversification. When assets are negatively correlated, they are less likely to move in the same direction simultaneously, reducing the overall risk. You can create a more stable and risk-averse portfolio by diversifying with uncorrelated assets, as gains in one asset can offset losses in others. On the other hand, positive correlations can limit the benefits of diversification, as assets move in tandem and do not provide the same risk reduction benefit.

Invest in Mutual Funds through SIP

Investing in mutual funds via SIPs is a wise way of advancing your wealth over time. SIPs permit you to invest a specified amount at predetermined intervals, often monthly. It offers you the advantage of capital appreciation while relishing the benefit of rupee cost averaging. To be precise, you purchase additional units when the NAV is low and fewer units when it is high. Consequently, investing in systematic investment plans (SIPs) can be an excellent method to diversify your portfolio without the fear of entering the market at the wrong time. By making regular investments, you can reap the benefits even if the market falls further. You get more units for the same investment amount, which can help you achieve your investment goals in the long run.

Therefore, SIP is a convenient and affordable way to participate in the financial markets, even with a modest budget, while diversifying your portfolio efficiently.

Diversify Your Debt Funds

Most investors don’t diversify their debt funds and only focus on equity funds. However, numerous debt fund options can be used for diversification, such as income funds, dynamic bond funds, liquid funds, etc. People often opt for either a secure debt fund or invest directly in specific debt instruments without giving much importance to the correlation between them. It is crucial to analyse your debt portfolio and invest in funds that do not correlate with your existing investments to ensure promising returns.

Diversify Your Equity Funds

Diversification based on capitalization entails investing in companies of varying sizes, such as large-cap, mid-cap, and small-cap stocks, to manage risk. Market sector diversification involves investing in industry sectors, like technology, healthcare, etc., to reduce sector-specific risk. By combining these two approaches, equity funds aim to create a well-rounded portfolio that maximizes portfolio returns, helping investors achieve balanced exposure to a variety of companies and sectors in the stock market. This diversification strategy seeks to achieve long-term financial growth while mitigating potential losses.

On a Parting Note

Diversity is valuable in many aspects of life, and it should not be overlooked when it comes to mutual fund investments. Portfolio diversification is a crucial strategy to mitigate risk and maximise returns. Knowing the correlation between different assets and investing through systematic investment plans (SIPs) is a smart approach to developing a well-rounded portfolio. It is essential to diversify your investment portfolio across various asset classes, capitalizations, and sectors for debt and equity funds to achieve long-term financial growth while minimizing potential losses. Consequently, embracing diversity in your mutual fund portfolio is vital for financial success.

Name: Tips for Managing Your Mutual Funds - BFC Capital- Blogs : All Financial Solutions for Growing Your Wealth

says:[…] The saying “Don’t put all your eggs in one basket” is commonly used to explain the importance of portfolio diversification. […]

Name: Why Quant Investing is Beneficial: Know the Key Advantages - BFC Capital- Blogs : All Financial Solutions for Growing Your Wealth

says:[…] that people are unable to discern. Quantitative investing aims to eliminate personal preferences, diversify portfolios, and possibly uncover hidden gems or outperform the market using facts and figures, not […]