Mutual funds vary from each other mainly established on their investment framework. This elemental aspect determines the versatility and ease of buying and selling mutual fund units.

When the mutual fund house provides a new mutual fund scheme, the scheme is presented to investors via a New Fund Offer (NFO). During this period, you can invest in mutual fund schemes. But, if the NFO gets over, the scheme might or might not enable existing or new investors to allow further purchases and redemptions.

This is where mutual funds start to differ from open-ended and close-ended ones.

In this blog, BFC Capital is going to walk you through everything you need to know about Open Ended and Close Ended Mutual Fund Schemes

Open Ended Mutual Fund

Open-ended funds are the ones that are popular as mutual funds. These funds are not bought or sold on public stock exchanges. However, there is no restriction on the number of units they can issue. The NAV changes every day due to variations in the fund’s underlying assets.

- Open-ended mutual fund units are bought or sold on demand at their Net Asset Value, or Nav, which is defined by the fund’s fundamental securities and evaluated at the end of every trading day. Investors buy units directly from the fund.

- Open-ended fund investments are evaluated at fair market value, based on the closing market value of listed public securities.

- Investors who are looking for high liquidity may consider investing in open-ended mutual fund schemes that don’t limit how many units you can buy or sell and don’t have a set end date. However, an exit load may be imposed when you redeem the units of open-ended schemes.

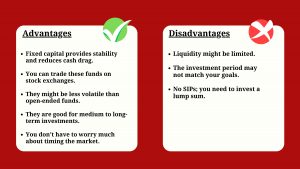

Advantages and Disadvantages of Open-ended Funds

Closed-Ended Mutual Funds

Close-ended mutual funds have a pre-established amount of fund units exchanged on stock exchanges. They are issued via a new fund offer (NFO) for fundraising and traded on the open market, correspondent to stocks.

- While the fund’s value is established on the NAV, the fund’s real price is symmetric to supply and demand. So, it could trade at higher or lower prices than its actual value.

- As a consequence, closed-end funds can trade at premiums or discounts to their net asset values (NAVs). Brokers handle the process of buying and selling closed-ended fund units. Closed mutual funds trade at a premium to their fundamental asset value and have a pre-established maturity period.

- Investors who look to exit the scheme may sell the units in the open market. But, given the restricted liquidity and the closed-ended character, it might take time and effort to find a buyer willing to pay your asking price.

- Some close-ended funds provide a choice of buying back the units after a particular time. It also enables investors an exit path before the maturity date.

Advantages and Disadvantages of Close Ended Funds

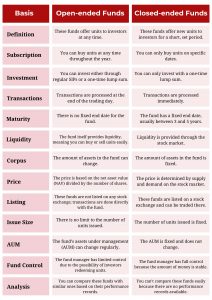

Difference Between Open Ended Vs Close Ended Mutual Fund Schemes

Conclusion

Both open-ended and closed-ended funds have their own advantages. To choose the right one, compare them directly, look at the risk and potential returns, and pick the fund that matches your financial goals and how much risk you’re comfortable with. But generally, as an investor you must go for a open ended fund as it provides you liquidity.

Which One Should You Opt For?

The choice totally depends on your investment needs and choice.

If you can manage to be invested for a long period, you can go with close-ended funds that give you safety and a chance of good return through the compounding of your money over time.

You will also need free lumpsum amounts to invest in closed-ended funds. On the contrary, if you want liquidity, open-ended funds may prove to be a good option.

To learn more about mutual funds, contact us via Phone, WhatsApp, Email, or visit our Website. Additionally, you can download the Prodigy Pro app to start investing today!

Disclaimer – This article is for educational purposes only and by no means intends to substitute expert guidance. Mutual fund investments are subject to market risks. Please read the scheme-related document carefully before investing.

Name: Maximizing Returns: How Portfolio Review Can Boost Your Mutual Fund Investments - BFC Capital- Blogs : All Financial Solutions for Growing Your Wealth

says:[…] Please share your thoughts on this post by leaving a reply in the comments section. Also, check out our recent post on: “Open Ended Vs Close Ended Mutual Fund Schemes“ […]