Everyone desires a stress-free and comfortable retirement. It’s safe to say that working hard in our youth is driven by our desire for a comfortable retirement and future. However, proper planning is necessary if you want to achieve this goal. Even though planning your retirement can be challenging, there are ways to make the journey less cumbersome. One such option is NPS or the National Pension Scheme. If you want to learn more about it and why you should invest in NPS, keep reading as we delve into all the details.

What is NPS?

The National Pension Scheme (NPS) is a government-regulated investment program that helps people plan for their future by allowing them to save systematically during their working years. Under the NPS scheme, you can invest a part of your income at regular intervals and redeem a portion of your savings once your retirement approaches. The remaining amount is disbursed on a monthly basis as a pension.

How Does NPS Work?

Before we delve deeper into why investing in NPS is a smart way of planning your retirement, let’s first see how the National Pension Scheme works.

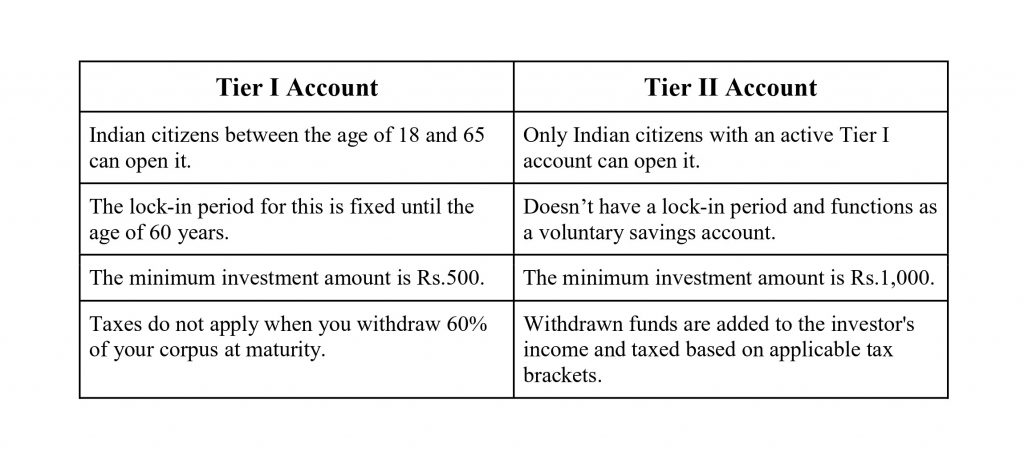

As mentioned earlier, the NPS scheme allows you to invest a portion of your income regularly. Once you create an NPS account, you’ll be assigned a Permanent Retirement Account Number (PRAN) that will stay with you for the rest of your life. The scheme has two options to choose from – Tier I and Tier II accounts – both of which have their own advantages. Let’s take a closer look at what each account offers.

Why Should You Invest in NPS?

It is always better to know the benefits of a scheme before investing in it. The assistance of a wealth manager and obtaining comprehensive knowledge about a scheme can aid in making an informed investment decision. The same applies to NPS as well. Saving for retirement is crucial, and investing in NPS can help you develop this habit. Here are some reasons why investing in NPS is a wise decision.

Works as a Regular Source of Income for Life

When you retire, you lose an active source of income, but the everyday expenses remain the same. Most individuals wish to have a comfortable lifestyle after they retire. But in order to make this happen, you need to have enough money saved up. NPS offers pensions, enabling you to become financially independent and not rely on others for monetary assistance post-retirement.

Offers Balanced Equity Exposure Strategy

NPS investments have a significant advantage over other investment options, given their limited exposure to equity and the risks associated with equity investments. The scheme caps equity exposure at a maximum of 75%, and for investors aged 50 years or more, it gradually reduces by 2.5% annually. As a result, investors can benefit from higher earnings while facing lower risk exposure.

The Flexibility of Fund Allocation

NPS offers a range of investment options at the time of portfolio formation. The investor has the flexibility to select the investment option that suits their needs. The investor can allocate the funds into four assets- equity, government bonds, corporate debt and alternative investment funds- based on their risk profile. The investors can reallocate these funds if they are unsatisfied with their performance.

Affordable Investment Option

NPS is considered an affordable investment option because it allows for contributions as low as Rs. 500 per month. Also, the scheme is regulated by the government, making it a popular choice for those on a budget.

You Can Save on Taxes Through NPS

Another reason you should invest in NPS is that it provides tax benefits under Section 80C of the Income Tax Act. Your NPS investment qualifies for tax deductions of up to Rs. 50,000 under Section 80 CCD (1B). NPS also offers a tax exemption of up to Rs. 1,50,000. This allows you to save an additional amount on tax every year. However, this benefit only applies to NPS Tier I accounts.

NPS is Professionally Managed

Lastly, one of the greatest advantages of investing in NPS is that it is regulated by Pension Fund Regulatory and Development Authority (PFRDA). With their transparent norms, the NPS trust regularly monitors and does performance reviews of fund managers. NPS has strict regulations to ensure that investments are managed professionally and that you reap maximum benefits from your investment.

On a Concluding Note

Everyone desires a stress-free and comfortable retirement, and the National Pension Scheme (NPS) is an excellent investment option to achieve this. It helps you save systematically during your working years and offers regular pensions, making you financially independent even after retirement. It is a low-risk investment option with the flexibility of fund allocation. It is also an affordable investment option that provides tax benefits and is professionally managed. With NPS, you can take control of your retirement planning and secure a comfortable future for yourself.

Please let us know your thoughts on this post by leaving a reply in the comments section. Also, check out our recent post on “Understanding Mutual Funds: Types and Benefits.”